No settling for less. No missing out.

Just on-demand solutions to boost your employee services and are ready to use anytime.

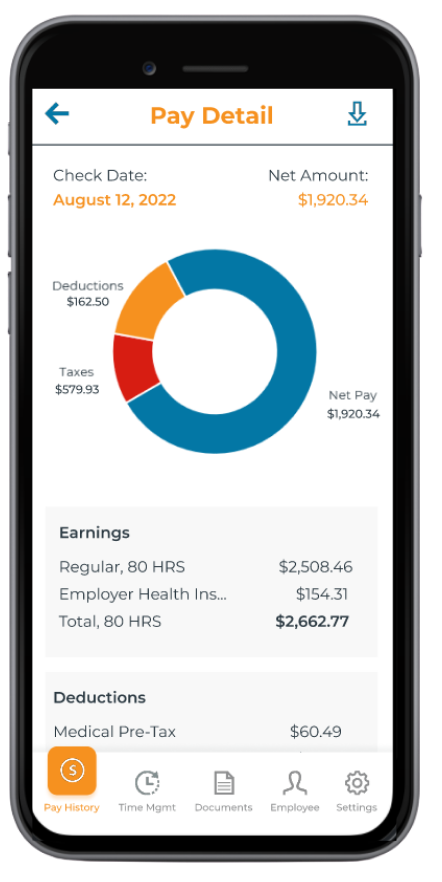

Mobile App – Employee Features

- 1Pay History – View pay history and personal earnings statements.

- 2Time Management – Clock in and out, switch department location and/or job, with an optional comment section.

- 3Employee – View employee contact information, status/position, accruals, direct deposits, and deductions.

- 4Documents – View and download tax forms (W-2s and 1095C).

- 5Settings – Switch companies (for multi-company users only), privacy notice, feedback, rate and log out of the app.

Financial Wellness That Works

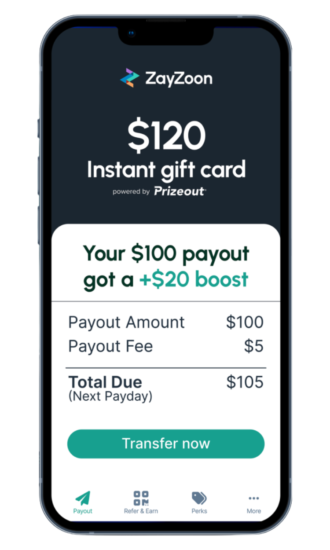

Wages on Demand, also known as Earned Wage Access, empowers employees by providing immediate access to their earned wages before the traditional payday.

This innovative solution allows workers to withdraw a portion of their earned income whenever they need it, promoting financial flexibility and reducing the stress of unexpected expenses. By offering this benefit, employers enhance employee satisfaction, retention, and overall financial well-being.

The Only Funding Solution Designed Exclusively for Payroll

Simple, Streamlined Pay

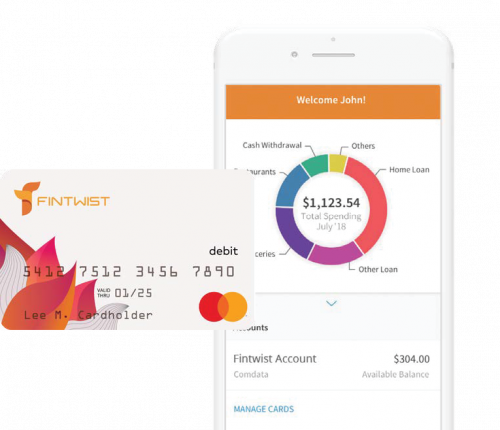

Pay Cards are a convenient and secure way for employees to receive their wages electronically. Instead of traditional paper checks or direct deposit into a bank account, employees are issued a debit card that provides access to earnings immediately.

Pay Cards can be used for everyday purchases, online shopping, and ATM withdrawals, making it easy for employees to manage their finances. This payment method not only streamlines payroll processes for employers but also provides employees with a flexible, safe, and efficient way to receive and spend their wages.

Pay Cards are ideal for those employees who do not have a bank account, but want the ease and benefit of electronic payroll.

Automated Income & Employment Verification

Employees rely upon employers to provide verification to support life events.

Income and employment verifications can take valuable time away from strategic work. They can also put your organization and employee data privacy at risk.

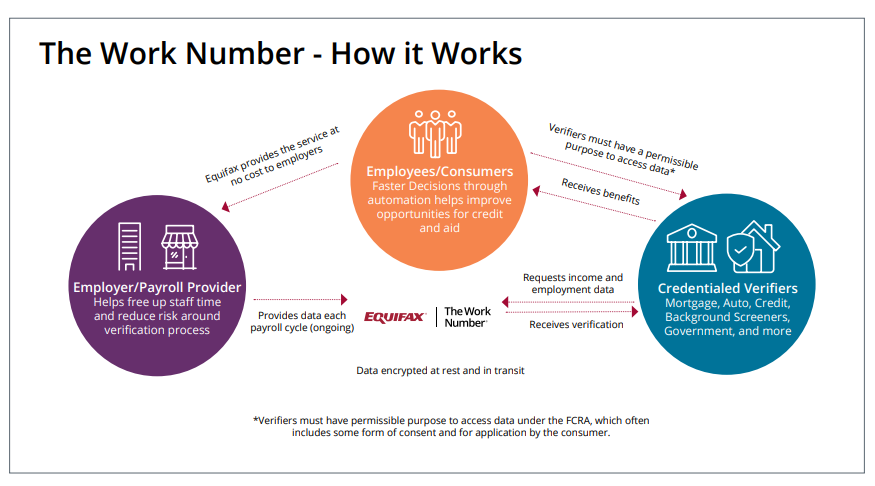

The Work Number® from Equifax automates verification when your employees are purchasing/leasing a home or a car, when requesting government benefits and more.

How it Works

Automated Service

Reduces the paperwork. The Work Number® service can lessen your manual verification workload.

Reduced Risk

When you respond directly to verification requests, your organization might be at risk for fraud or error. The Work Number® automates the verification response and reduces risk over a manual HR verification process.

Benefits Employees

Faster and more informed decisions by lenders and government agencies can improve opportunities for credit and aid.

Governed by the Fair Credit Reporting Act

The Work Number® is governed by the Fair Credit Reporting Act (FCRA), which helps ensure verifiers have a valid reason to obtain employment information and employees can see who has requested their information and can dispute information that may be incorrect.

Privacy and Security

The Work Number® uses stringent security standards to help protect employee information including data encryption, physical security controls, and user identity verification. Requests are typically initiated by employees, usually at the time of application, and only accepted from credentialed verifiers.