No administrative complexities. No manual uploads.

Just a comprehensive retirement solution to help businesses and employees save for retirement.

Retirement Plan Options

We provide three retirement plan options tailored to meet your organization’s needs. Our plans feature institutional pricing and investment advisory services, helping to ease your fiduciary responsibilities as an employer. Whether you’re introducing a new retirement plan or enhancing an existing one, we’re here to help you do more.

The Payentry Retirement Advantage

Low Employer Cost

Our plans typically offer pricing that is 10-20% lower than our competitors, making it affordable to offer retirement as a benefit.

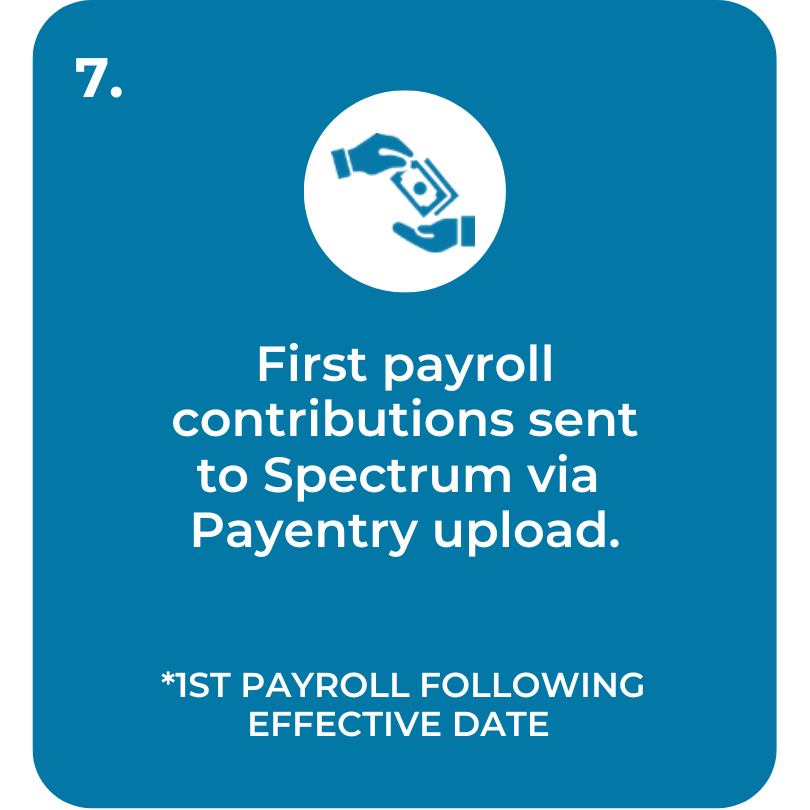

Automatic Payroll Deduction

Reduce duplicate data entry, keying errors, and compliance issues.

Employees Save More for Retirement

All funds are offered at institutional pricing without commissions.

Whether you are looking to add a new plan or have existing retirement options, we help you do more.

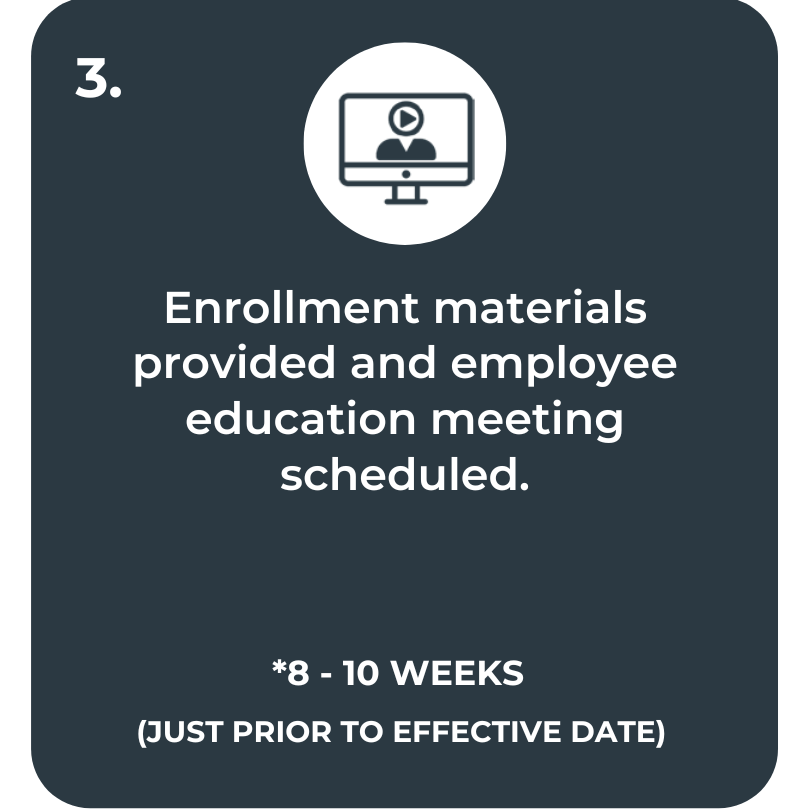

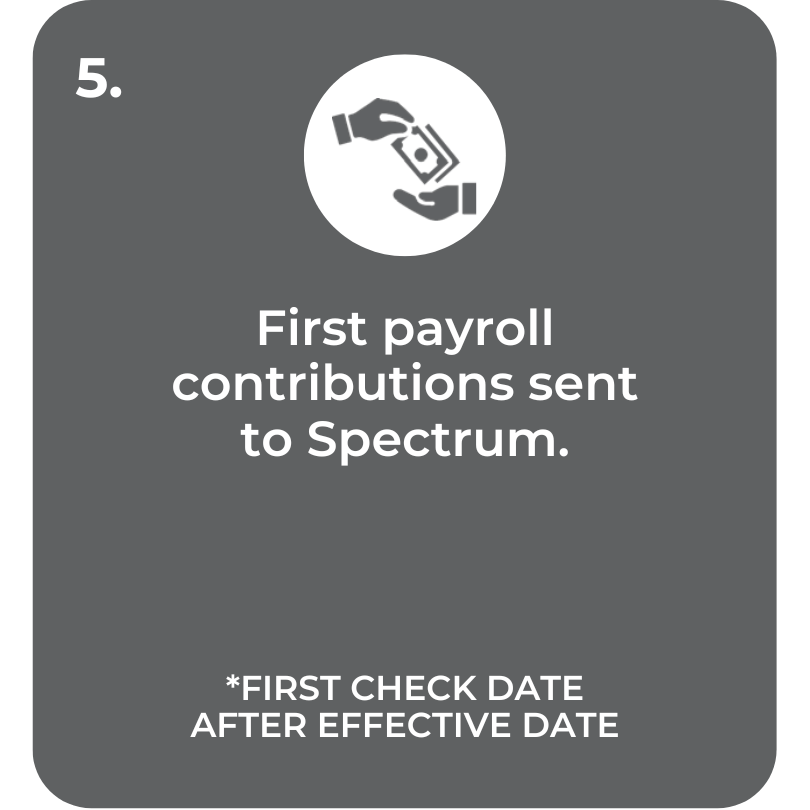

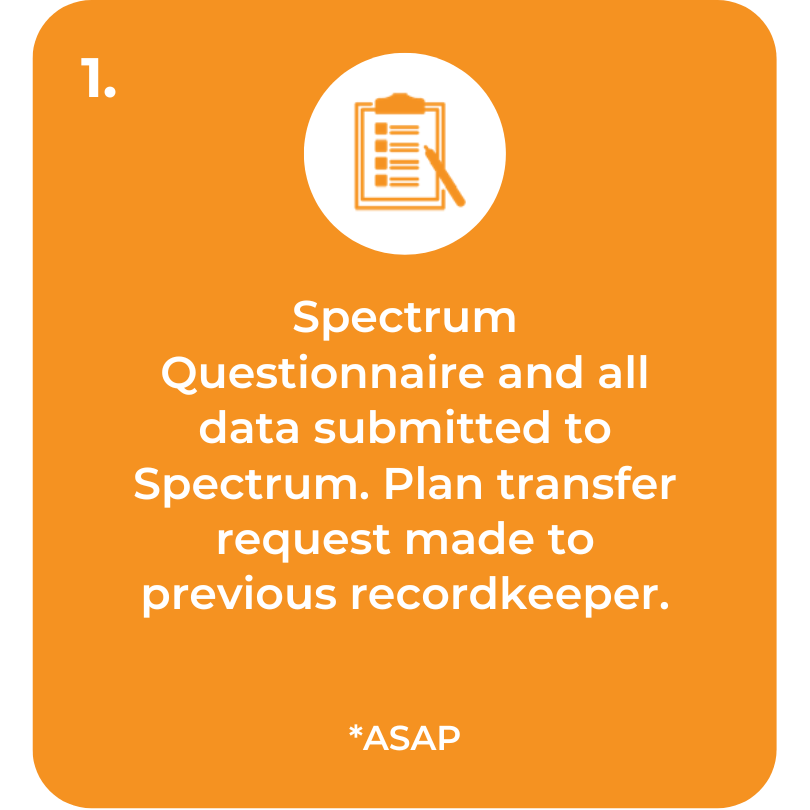

Retirement Start-Up Timeline

The typical implementation timeline is between 60 – 90 days once your questionnaire and all documentation has been submitted.

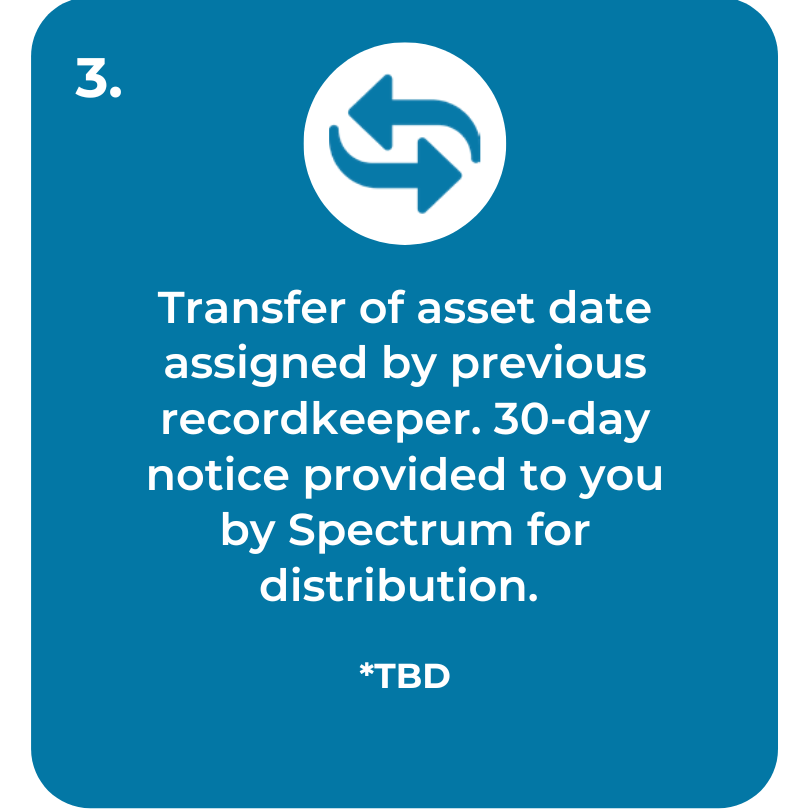

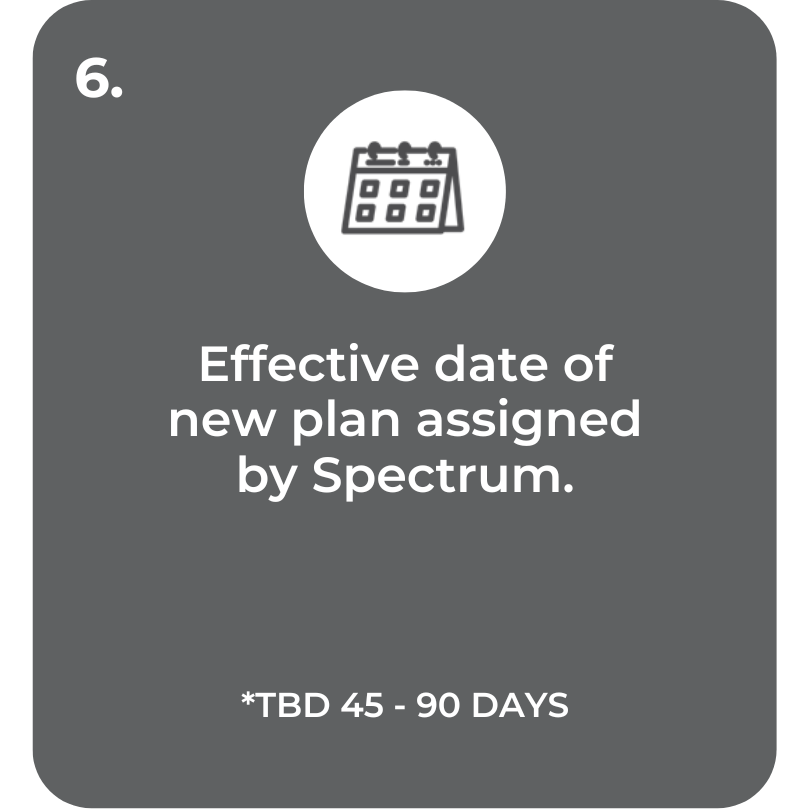

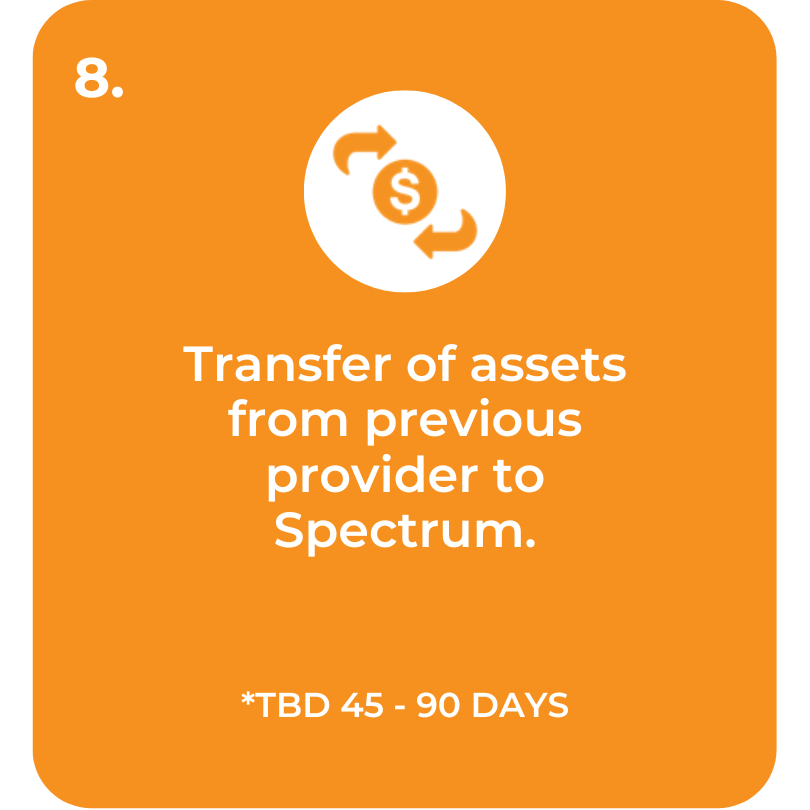

Retirement Conversion Timeline

The typical conversion and implementation timeline is between 60 – 90 days once your questionnaire and all documentation has been submitted.

“Our goal is to empower businesses with retirement solutions that secure a brighter future for their employees while simplifying the process for employers. We’re here to ensure every step is seamless and impactful.”

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker-Dealer member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Payentry Financial Services are not affiliated. The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this email in error, please reply to the sender to inform them of this fact. We cannot accept trade orders through email. Important letters, email, or fax messages should be confirmed by calling 704-609-8405. No Texts. This email service may not be monitored every day or after normal business hours.