Blog

Effective employee coaching and progressive discipline are essential components of maintaining a productive and positive workplace.

We are pleased to announce our new strategic partnership with Equifax Workforce Solutions. The Work Number® from Equifax is an automated Income and Employment Verification Service...

Maximizing return on investment (ROI) with payroll services requires a strategic approach focused on efficiency, compliance, and accuracy.

The shift to remote work has transformed the traditional office environment, bringing both opportunities and challenges for businesses.

A payroll calendar is a vital tool that outlines key dates and deadlines associated with payroll processing within an organization. Acting as a roadmap for employers and employees...

Chances are that whenever you get paid, you receive a pay stub, or wage statement, describing details of the payment.

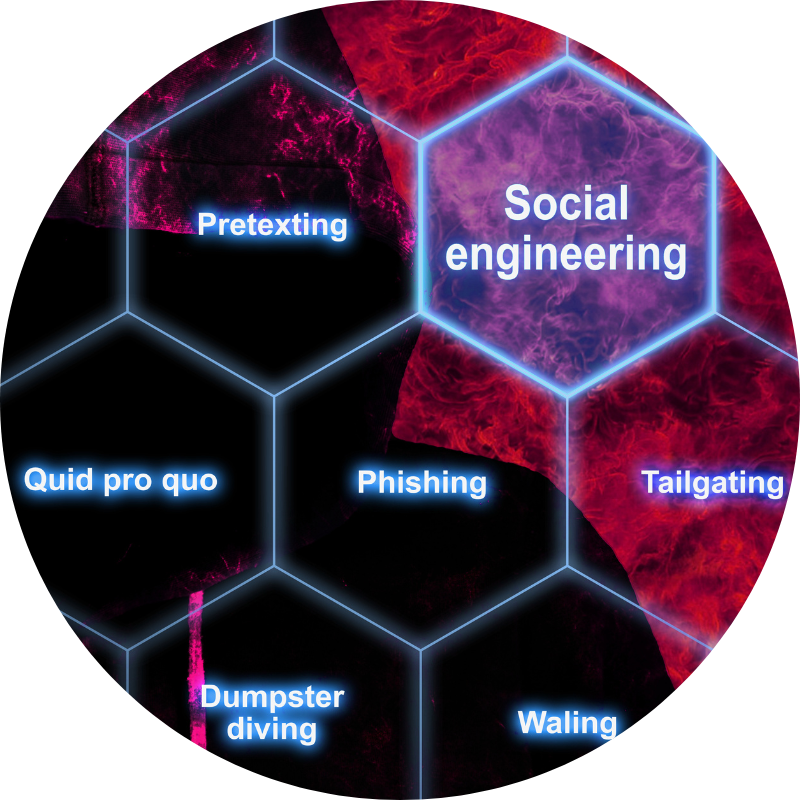

In the world of cybersecurity, threats evolve as quickly as technology advances. One sophisticated, yet often overlooked tactic, is the quid pro quo attack...

In today’s fast-paced work environment, employees can often feel like just another cog in the wheel, making it more important than ever to ensure...

In the world of physical security, "Tailgating" isn't about barbecues or sporting events.

In the realm of cybersecurity, not all threats come in the form of viruses or malware.