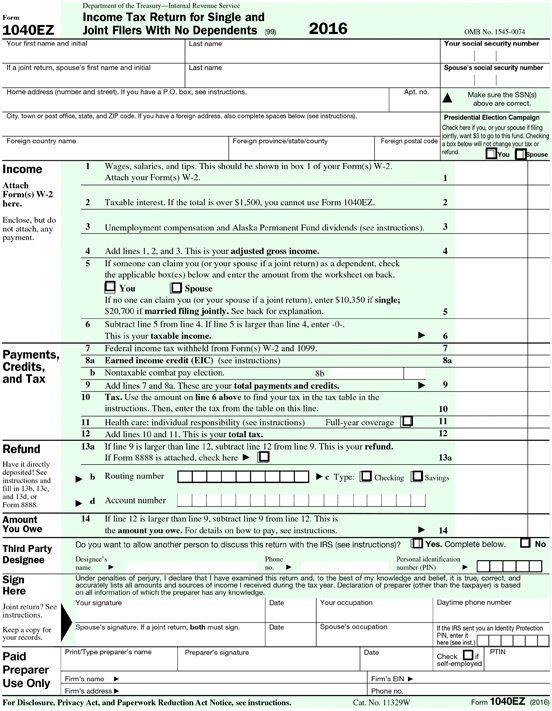

Form 1040EZ

Form 1040EZ is the simplest form to use

You can use Form 1040EZ if all of the following apply:

- Your filing status is single or married filing jointly. If you were a nonresident alien at any time in 2017, your filing status must be married filing jointly.

- You (and your spouse if marries filing a joint return) were under age 65 and not blind at the end of 2017. If you were born on January 1, 1953 you are considered to be age 65 at the end of 2017.

- You don’t claim any dependents.

- Your taxable income is less than $100,000.

- Your income is only from wages, salaries, tips, unemployment compensation, Alaska Permanent Fund dividends, taxable scholarship and fellowship grants, and taxable interest of $1,500 or less.

- You don’t claim any adjustments to income, such as deduction for IRA contributions or student loan interest.

- You don’t claim any credits other than the earned income credit.

- You don’t owe any household employment taxes on wages you paid to a household employee.

- If you earned tips, they are included in boxes 5 and 7 of your form W-2

- You are not a debtor in a chapter 11 bankruptcy case filed after October 16, 2005.

You must meet all of these requirements to use Form 1040EZ. If you don’t, you must use Form 1040A or Form 1040.

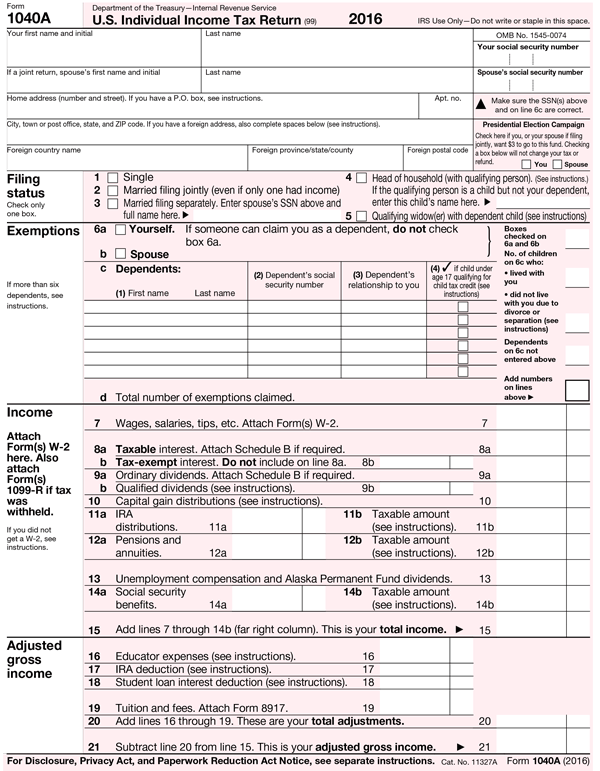

Form 1040A

If you don’t qualify to use Form 1040EZ, you may be able to use Form 1040A

You can use Form 1040A if all of the following apply:

- Your income is only from:

- Wages, salaries, and tips,

- Interest,

- Ordinary dividends (including Alaska Permanent Fund dividends),

- Capital gain distributions

- IRA distributions

- Pensions and annuities

- Unemployment compensation

- Taxable social security and railroad retirement benefits and

- Taxable scholarship and fellowship grants

If you receive a capital gain distribution that includes unrecaptured section 1250 gain, section 1202 gain, or collectibles (28%) gain, you can’t use Form 1040A. You must use Form 1040.

- Your taxable income is less than $100,000

- Your adjustments to income are only for the following items:

- Educator expenses

- IRA deduction

- Student loan interest deduction

- Tuition and fees

- You don’t itemize your deductions

- You claim only the following tax credits:

- The credit for child and dependent care expenses

- The credit for the elderly or the disabled

- The education credits

- The retirement savings contributions credit

- The child tax credit

- The earned income credit

- The additional child tax credit

- The premium tax credit

- You didn’t have an alternative minimum tax adjustment on stock you acquired from the exercise of an incentive stock option

You can also use Form 1040A if you received employer-provided dependent care benefits or if you owe tax from the recapture of an education credit or the alternative minimum tax.

You must meet all these requirements to use Form 1040A. If you don’t, you must use Form 1040.

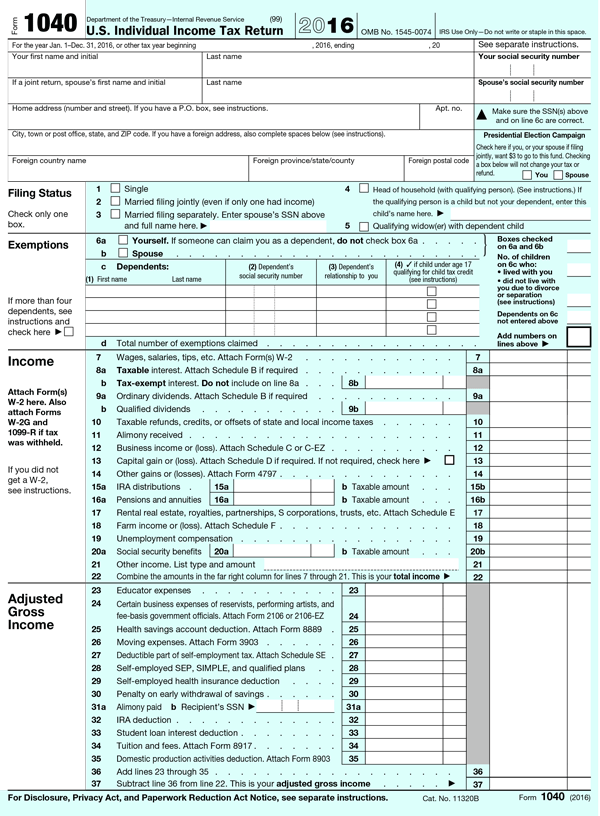

Form 1040

If you can’t use Form 1040EZ or Form 1040A, you must use Form 1040. You can use Form 1040 to report all types of income, deductions, and credits

You may pay less by filing Form 1040 because you can take itemized deductions, some adjustments to income, and credits you can’t take on Form 1040A or Form 1040EZ.

Use must use Form 1040 if any of the following apply:

- You taxable income is $100,000 or more.

- You itemize your deductions on Schedule A

- You had income that can’t be reported on Form 1040EZ or Form 1040A, including tax-exepemt interest from private activity bonds issued after August 7, 1986.

- You claim any adjustments to gross income other than the adjustments listed earlier under Form 1040A.

- Your Form W-2, box 12, shows uncollected employee tax (social security and Medicare tax) on tips or group-term life insurance.

- You received $20 or more in tips in any 1 month and didn’t report all of them to your employer.

- You were a bona fide resident of Puerto Rico and exclude income from sources in Puerto Rico.

- You cliam any credits other than the credits listed earlier under Form 1040A.

- You owe the excise tax on insider stock compensation from an expatriated corporation.

- Your Form W2 shows an amount in box 12 with code Z.

- You had a qualified health savings account funding distribution from your IRA.

- You are an employee and your employer didn’t withhold social security and Medicare tax.

- You have to file other forms with your return to report certain exclusions, taxes, or transactions, such as Form 8959 or Form 8960.

- You are a debtor in a bankruptcy case filed after October 16, 2005

- You must repay the first-time homebuyer credit

- You have adjusted gross income of more than $155, 650 and must reduce the dollar amount of your exemptions.

- You received a Form W2 that incorrectly includes in box 1 amounts that are payments under a Medicaid waiver program and you can’t get a corrected Form W2.