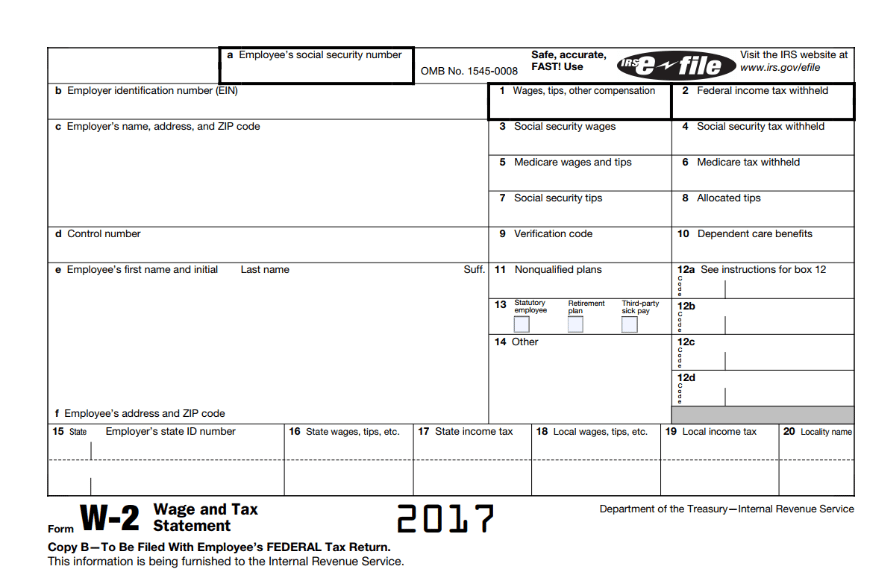

Boxes a-f reflect company information and the demographic information you have on file with the employer that has provided the W-2. Be sure to review your information for accuracy and contact your employer if any changes need to be made.

Total federal taxable wages are reported here. Not included in this section are Section 125 eligible health insurance, 401k contributions, qualified moving expenses and other excludable items.

The total amount your employer withheld from your paychecks for federal income taxes. This represents the amount of federal taxes you have paid in throughout the year.

Wages subject to social security tax, with a maximum of $127,200 for 2017.

Your employee taxes withheld and paid towards Social Security, with a 2017 maximum contribution of $7886.40 (6.2% of $127,200).

Total wages that are subject to Medicare tax. There is no maximum wage base for Medicare and this amount does include any deferred compensation, 401k contributions or other fringe benefits.

Medicare tax withheld from your pay at a rate of 1.45% (individuals who earn more than $200,000 contribute an additional 0.9% on wages in excess of $200,000 – Find out more on the IRS website.)

Total tips reported if you are employed in an establishment in which tips are earned. This box will be empty if you didn’t report any tips.

Here you will find tips allocated from employer to employee (this will only pertain to certain jobs).

Ignore this box.

This section is for dependent care benefits such as daycare etc. This will be any amount you may have been reimbursed for dependent care expenses through a flexible spending account, or the dollar value of dependent care services provided to you by your employer. Amounts under $5,000 aren’t taxable.

This section is to report any amount that was distributed to you from your employer’s non-qualified deferred compensation plan.

This is for various benefits and compensation you receive with special tax qualifications such as adoption benefits (Code T), 401k contributions (Code D) etc. See the bottom of this page for a full list of Box 12 lettered codes.

These boxes are checked if you are an independent contractor and have a qualifying retirement plan such as a 401K or the W2 form is being filled out by a third party employer who is not your actual employer.

This section is where your employer can report any additional tax information such as travel reimbursements, union dues, uniform reimbursements etc.

Employer’s state ID number, this will be filled out by your employer.

This section reports the total amount of taxable wages you earned in that state. If you worked in more than one state for the same employer there may be more than one line of information.

Total amount of state income tax withheld from the wages reported in box 16.

Total amount of wages subject to any local, city or other state income taxes.

Total amount local, city or other state income taxes (if any).

A brief description of the local or city tax being paid in box 19.

Box 12 Codes:

- A — Uncollected Social Security or RRTA tax on tips

- B — Uncollected Medicare tax on tips

- C — Taxable Cost of group-term life insurance over $50,000

- D — Elective deferral under a 401(k) cash or arrangement plan. This includes SIMPLE 401(k) arrangement

- E — Elective deferrals under a Section 403(b) salary reduction agreement

- F — Elective deferrals under a Section 408(k)(6) salary reduction SEP

- G — Elective deferrals and employer contributions (including non-elective deferrals) to a Section 457 (b) deferred compensation plan

- H — Elective deferrals to a Section 501 (c)(18)(D) tax-exempt organization plan

- J — Nontaxable sick pay

- K — 20% excise tax on excess golden parachute payments

- L — Substantiated employee business expense reimbursements (nontaxable)

- M — Uncollected Social Security or RRTA tax on taxable cost of group-term life insurance over $50,000 (former employees only)

- N — Uncollected Medicare tax on taxable cost of group-term life insurance over $50,000 (former employees only)

- P — Excludable moving expense reimbursements paid directly to employee

- Q — Nontaxable combat pay

- R — Employer contributions to your Archer medical savings account (MSA)

- S — Employee salary reduction contributions under a Section 408(p) SIMPLE

- T — Adoption benefits (not included in Box 1)

- V — Income from exercise of non-statutory stock options

- W — Employer contributions (including amounts the employee elected to contribute used Section 125 cafeteria plan) to your health savings account (HSA)

- Y — Deferrals under a Section 409A nonqualified deferred compensation plan

- Z — Income under a Section 409A on nonqualified deferred compensation plan

- Code AA — Designated Roth contribution under a 403(b) plan

- CC — For employer use only

- DD — Cost of employer-sponsored health coverage

- EE — Designated Roth contributions under a government 457(b) plan